By Eustace Davie

Every nation has a choice between having either a closed, highly regulated and stagnant economy or an open, free and rapidly growing economy. It is time for SA to choose freedom over repression, starting with a sound currency as a basis for building a thriving economy.

One country after another is experiencing fiscal and monetary problems, with Cyprus and Portugal hitting the recent headlines. This is causing a great deal of unease worldwide. Bold policies are necessary to counter the ill effects of the monetary mayhem other countries are facing, which is rooted in fiat currencies (paper money backed by nothing).

Prudence in monetary and fiscal management has become a quaint notion that many politicians and central bankers appear to believe belongs to ages past. Deficit budgeting and paralysing government debt has become the norm, and currency debasement through the issue of large quantities of paper money is being touted as the solution to financial crises. Governments are working hard to convince everyone that they are debasing their country’s currencies for the benefit of their citizens and the many financial crises are supposedly no fault of the politicians and central bankers of the countries concerned.

Resorting to competitive currency debasement in an effort to out-compete other exporting nations is nothing new. Similar destructive behaviour occurred towards the end of World War II. Fortunately, wise heads prevailed and the carnage was ended when the representatives of the forty four Allied nations signed the Bretton Woods Agreement in July 1944. The agreement anchored the currencies of all participants on the US dollar, which was in turned tied to gold by a US undertaking to exchange dollars for gold at a fixed rate of $35 per ounce.

The Bretton Woods monetary arrangement was critically dependent on the US not debasing the dollar by excessively increasing the number of dollars in circulation. After a quarter of a century, US monetary discipline gave way in the early 1970s when the US government, rather than raise taxes, resorted to the printing press to pay for the costs of the Vietnam war and increased social spending. As concern about the state of the US economy increased, France ($191 million) and Switzerland ($50 million) redeemed their excessive dollars for gold at $35 per ounce, followed by other countries who demanded the same, thus reducing the US 1944 gold holdings by half to about 285 million ounces. On 15 August 1971, US President Richard Nixon issued an Executive Order “closing the gold window”, which meant reneging on and ending the Bretton Woods Agreement, and ushering in the era of worldwide fiat currencies.

Despite the closing of the “gold window”, the US dollar has maintained its status as the world reserve currency, principally because so many contracts (such as oil) are denominated in dollars but also because the US economy has remained comparatively healthier than the economies of other countries. Unwise US monetary and fiscal management in recent years, however, has reduced the standing of the US economy and its currency. To remain competitive on exports most other countries have been debasing their currencies at a more rapid rate than the decline of the dollar’s purchasing power. SA’s Reserve Bank should refrain from joining this lemming-like march to currency destruction.

Until recently Japan has not been following a destructive monetary pattern but has now decided to change. The new Bank of Japan governor, Haruhiko Kuroda, is “heeding the demands” of his Prime Minister, Shinzo Abe. In order to achieve an inflation rate of 2% “as soon as possible” (currently -0.60%) the central bank will double Japan’s monetary base in not more than two years, increasing it by ¥60tn (R5 455bn) to ¥70tn (R6 364bn) per year. This process of “quantitative easing” (the euphemistic term for currency debasement) holds dire consequences for the economies that practice it. Establishing a hard currency is a much more sensible option.

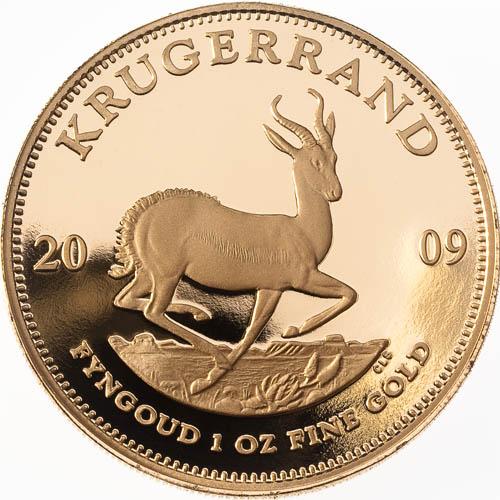

The mechanics of establishing a gold-based Currency Board for SA are straight-forward. According to the 31 March 2013 statement of assets and liabilities published by the SA Reserve Bank (31 March 2008 figures in brackets), the liabilities reflected Notes and Coins in Circulation amounting to R103.4bn (63.4bn), and the assets included R59.3bn (37.7bn) in gold, comprising 4,021,814 (3,996,992) ounces valued at R14,742.16 (R7,589.30) per ounce. At the same price, to fully back the notes and coins in circulation with gold, a purchase of a further R44.1bn (R33.1bn) of gold would have been necessary.

On 31 March 2013, one rand would have been declared to be equivalent to 1/14,742.16th (1/7,589.30th) of an ounce of gold, fixed for all time. While the Currency Board would be compelled to maintain precisely correct gold holdings at the fixed weight of gold per rand to cover notes and coins in issue, it would not undertake to part with any of its gold in exchange for notes and coins. Full convertibility would require more fundamental currency reform. The figures show that the rand has been in steady decline against gold. Since 1980 the rand has lost 90 per cent of its value against the dollar, which has lost 92.5 per cent of its value against gold.

In the absence of a Bretton Woods-type agreement to again anchor world currencies to a commodity such as gold, currency markets will remain in turmoil, which may be good for currency traders but not for economic activity aimed at delivering goods and services. Such conditions create what represents a “golden” opportunity for one country, especially a gold-producing country such as SA, to establish what is known as a “hard” currency. A hard currency is one that does not constantly lose value against other currencies, or against general prices of goods and services.

If SA adopted this Currency Board proposal it would need to abolish exchange controls, repeal its legal tender laws, and develop a multi-currency economy. Such changes would overcome problems that exporters would otherwise experience in operating from a “strong” currency jurisdiction in a world of depreciating currencies. Firms would then conduct business in any currency of their choice, synchronising the currencies used with their export destinations.

A fully gold-backed monetary base would without doubt attract foreign investment, especially from investors that favour sound money and free markets. If government wants high growth it will have to seriously consider discarding all legislation, regulations and policies that are likely to represent serious disincentives to investment. The economy would benefit substantially from total free trade, a currency that is fully backed by a commodity such as gold, and a regulatory environment that makes SA a top destination for ease of doing business.

Originally published at the Free Market Foundation.

Eustace Davie is a director of the Free Market Foundation.